Flexible Printed Circuit (FPC), also known as "FPC soft board," is a printed circuit board made using flexible insulating substrates.

FPC offers excellent electrical performance, meeting the needs of smaller and higher density installation designs, and also helps to reduce assembly processes and enhance reliability. Flexible printed circuit boards are the only solution to meet the requirements of miniaturization and mobility in electronic products. They can be freely bent, wound, folded, and can withstand millions of dynamic flexes without damaging the wires. They can be arranged arbitrarily according to space layout requirements and moved and expanded freely in three-dimensional space, thereby achieving the integration of component assembly and wire connection. The flexible printed circuit board can greatly reduce the size and weight of electronic products and are suitable for the needs of electronic products developing towards high density, miniaturization, and high reliability.

Printed Circuit Boards (PCB) are key electronic interconnects in electronic products, connecting various electronic components through circuits to achieve conduction and transmission. Based on flexibility, PCB can be divided into rigid printed circuit boards, flex (flexible) printed circuit boards (FPC), and rigid-flex printed circuit boards.

FPC (Flexible Printed Circuit) refers to flexible printed Printed Circuit Board circuits, commonly known as "soft boards". They are made by laminating with flexible copper-clad laminates (FCCL) and flexible insulating layers using adhesives (glues).

Compared with traditional rigid PCB boards, FPCs have significant advantages such as high production efficiency, high wiring density, light weight, thin thickness, foldability, bendability, and three-dimensional wiring capabilities. They better align with the trends of intelligence, portability, and thinness in the downstream electronics industry and are suitable for electronic products requiring miniaturization, lightweight, and mobility. Notably, fpc used in industrial electronics has become increasingly common, as their flexibility and reliability meet the demands of industrial IoT devices, automation control systems, and high-precision sensors.

According to Prismark data, from 2021 to 2026, the global FPC market size will grow from 14.1 billion USD to 17.2 billion USD, with a CAGR of 4.1%.

The upstream of the FPC industry chain involves raw materials such as flexible copper-clad laminates (FCCL), while the downstream includes end-user consumer electronic products.

Globally, Japanese enterprises currently dominate the upstream of the industry chain, a short-term trend that is unlikely to change. The downstream products of the industry chain are showing increasingly diversified development trends.

The main raw materials upstream of the FPC industry chain include eight major categories: flexible copper-clad laminates (FCCL), cover films, components, shielding films, adhesive tapes, steel sheets, plating additives, and dry films.

All processing procedures of FPC are done on FCCL. FCCL is the key substrate for producing FPC, with costs accounting for 40%-50% of the total.

FCCL consists mainly of rolled copper foil, polyimide (PI) film or polyester (PET) film substrate film, and adhesives, with PI film being its core raw material.

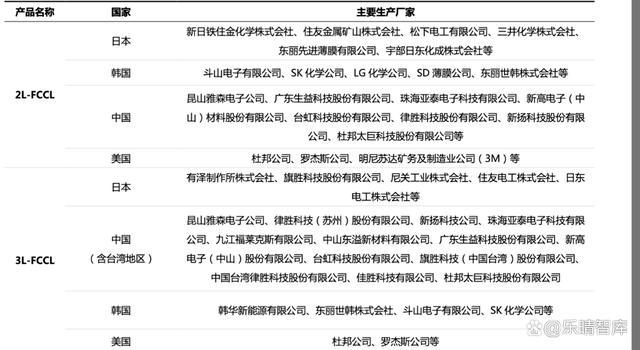

Global FCCL production capacity is mainly concentrated in Japan, Mainland China, South Korea, and Taiwan, China. With the continuous release of domestic FCCL capacity, Mainland China FPC companies are gradually realizing domestic substitution in the upstream raw material field of FPC.

Polyimide (polyimide, PI), an aromatic heterocycle containing an imide group, is currently one of the best heat-resistant polymer materials in engineering plastics.

Domestic polyimide film is mainly used for ordinary electrical grade film and electronic products, such as cover film, reinforcement film. The market for high-end PI pastes and PI films is basically monopolized by foreign countries.

Domestic enterprises mainly include Damai Technology and Dasheng Technology in Taiwan, as well as Ruihuatai, Times New Material, Danbang Technology and Dinglong Stock (PI slurry) in mainland China. And the United States DuPont, Japan Zhong Yuan chemical, Japan Toray, UBE and South Korea SKC, the U.S., Japan and South Korea companies accounted for 64% of the market share of PI, the formation of a foreign oligopoly.

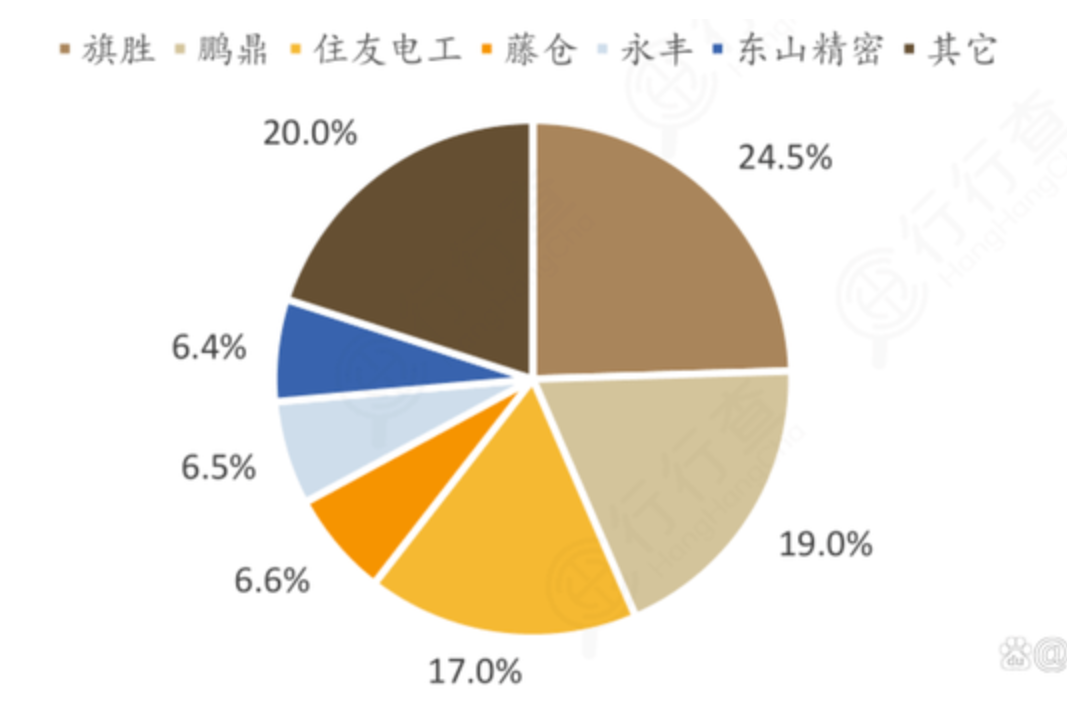

FPC is a global fully competitive industry, the competitive landscape is centralized, the top four manufacturers and market share of nearly 70%. Japan's Flagship and Peng Ding Holdings for the world's Top 2 FPC suppliers, its share of other manufacturers ahead of more.

At present, the global leading enterprises in the FPC product process capability, its line width line pitch can reach 30-40μm, aperture diameter of 40-50μm, and further to 15μm and the following line width line pitch, aperture diameter of 40μm below the direction of development.

Domestic local head enterprises in the FPC product process capability, also broke through the 40-50μm line width pitch, 70-80μm aperture technology, and further to the 40μm line width pitch, 60μm aperture below the breakthrough in process capability.

Local enterprises are representative of the FPC manufacturers, including Peng Ding Holdings, Dongshan Precision, Hongxin Electronics, Transfar Technology, up to the electronics, Jingwang Electronics, Ai Sheng Precision, in the capital of the Yuan Sheng and so on.

In recent years, the Japanese system leader Flag Technology began to shift to the high margin automotive market, Sumitomo Electric, Fujikura, etc. began to shrink the supply of A customers, Peng Ding Holdings and Dongshan Precision vigorously invested in automated production lines, the share of continued growth, Taiwan-based companies are relatively stable.

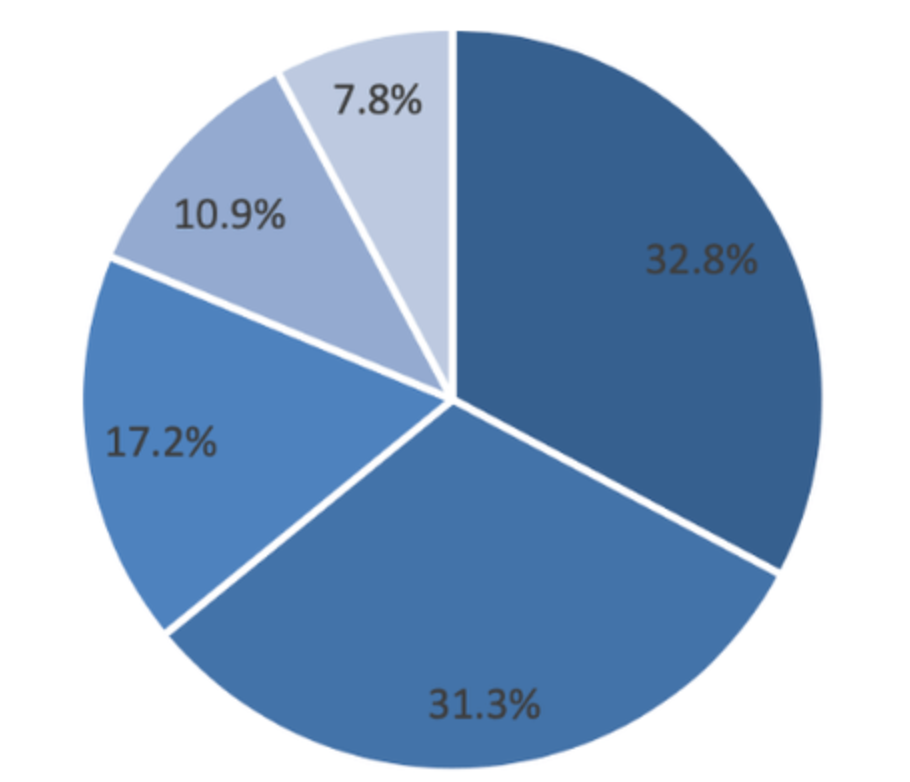

In the distribution of PCB global output value in 2021, China and Taiwan with 32.8% of the share ranked first, China's share rose to 31.3%, ranked second, Japan's share of the output value declined to 17.2%, a drop of more than 50%.

In recent years, overseas PCB manufacturers, represented by Japanese enterprises, have been less willing to expand production and gradually withdrawn. Mainland China to actively undertake industrial transfer, PCB output value and its share in the world is rapidly increasing, the future of domestic FPC still has a broad alternative space.

The downstream of the FPC industry chain is for various applications, including display/touch modules, fingerprint identification modules, camera modules and so on.

End applications include consumer electronics, communication equipment, automotive electronics, industrial control medical, aerospace and other fields. As a result, flexible pcb applications play a vital role in enabling these advanced technologies.

From the downstream point of view, smartphone function innovation and high-capacity battery compression of internal space, FPC single machine dosage enhancement; wearable equipment high growth increased FPC usage; AR / VR rapid growth opened up a new scene of soft board applications; automotive electrification and intelligence brought FPC single vehicle value of a substantial increase in volume. One of the power battery FPC instead of copper wire harness trend is clear, enhance the FPC single car value of about 600 yuan.

With the downstream terminal product replacement accelerated and its brand concentration is increasing, the head of the FPC manufacturers with the existing technology and scale advantages. By building up industry barriers and consolidating their dominant position in competition, the market concentration of the industry has been further increased.

Along with the further improvement of China's FPC industrial chain, the steady improvement of technology level and the continuous enhancement of production capacity, domestic FPC enterprises are capable of meeting the demand for FPC in new energy automobile and emerging consumer electronics, and the competitiveness of domestic FPC enterprises will continue to strengthen, and the market share will also increase.

Advantages and Applications of Polyimide Film Heater

16 Apr 2025

Polyimide film heater is a high-performance electric heating element made by using polyimide film as the outer insulation layer, metal foil or metal wire as the inner conductive heating element, and b...

Advantages and Applications of Polyimide Film Heater

16 Apr 2025

Polyimide film heater is a high-performance electric heating element made by using polyimide film as the outer insulation layer, metal foil or metal wire as the inner conductive heating element, and b...

Call us on:

Call us on:  Email Us:

Email Us:  No.198 Houxiang Road, Haicang District, Xiamen, China

No.198 Houxiang Road, Haicang District, Xiamen, China